This text is an on-site model of our Disrupted Occasions publication. Sign up here to get the publication despatched straight to your inbox thrice per week

Immediately’s prime tales

For up-to-the-minute information updates, go to our live blog

Good night.

Asia faces one of many worst economic outlooks for half a century because of a sluggish post-pandemic restoration, China’s property disaster, rising ranges of debt and US protectionism.

That’s in the present day’s verdict from the World Financial institution which downgraded its development forecast for China from 4.8 per cent to 4.4 per cent subsequent yr and for the broader set of creating economies in east Asia and across the Pacific from 4.8 per cent to 4.5 per cent.

The area, one of many world’s essential development engines, is now more likely to expertise the slowest tempo of enchancment for the reason that late Nineteen Sixties, barring extraordinary durations across the pandemic, the Nineteen Seventies oil shock and the Asian monetary disaster.

China is the principle barrier to progress as a consequence of plenty of components together with the precarious state of its property sector, which usually accounts for greater than 1 / 4 of exercise on this planet’s second-largest financial system, prompting Beijing final month to unleash a huge stimulus programme to rekindle demand.

Retail gross sales in the meantime have fallen to pre-pandemic ranges, though economists consider there could possibly be a lift in spending on eating places and outings throughout China’s Golden Week, the longest vacation break of the yr, which begins in the present day.

Foreign investors are concerned however there have been indicators of life prior to now few weeks. Manufacturing unit exercise expanded in September for the primary time in six months based on government PMI data on Saturday, whereas S&P Global data yesterday additionally confirmed enchancment. Client costs have edged again from deflation and the speed of decline in exports has eased.

There has additionally been optimistic information on commerce tensions after a brand new “mechanism” was agreed with the EU to discuss export controls, mirroring an analogous effort between Beijing and Washington. Because the FT’s chief economics commentator Martin Wolf just lately concluded, it’s far too soon to write off China just yet.

Elsewhere there are indicators that weakening world demand is taking its toll.

Items exports are considerably down in Indonesia, Malaysia and Vietnam and the World Financial institution’s worsening forecasts replicate the potential injury from US industrial and commerce insurance policies encapsulated within the Inflation Discount Act and the Chips and Science Act. International locations similar to Vietnam are combating again, unveiling billions of dollars in deals with the US on semiconductors and AI.

The way in which ahead for the area was via deeper service sector reforms, mentioned World Financial institution economist Aaditya Mattoo. “In a area which has actually thrived via commerce and funding in manufacturing . . . the subsequent large key to development will come from reforming the companies sectors to harness the digital revolution,” he mentioned.

Must know: UK and Europe financial system

Prime minister Rishi Sunak’s weakening of UK local weather insurance policies has left exporters facing hefty EU carbon tax bills. The collapse of the nation’s carbon market, which units the value to be paid for each tonne of CO₂ launched, means the UK might be hit by EU guidelines that penalise international locations with considerably decrease carbon prices.

Home costs fell throughout all UK areas for the first time since 2009 within the three months to September as excessive mortgage charges took impact, based on mortgage lender Nationwide. The development business is bearing the brunt of a cooling UK labour market.

Anti-Ukraine former prime minister Robert Fico is ready to attempt to type a coalition authorities after profitable Slovakia’s elections, doubtlessly becoming a member of Hungary in undermining western unity in serving to Kyiv in its battle in opposition to Russia.

EU plans to implement 30-day cost phrases have dismayed retail teams, which say the proposals will inadvertently push up prices and encourage them to buy more from China. UK companies in the meantime are bracing for the influence of new post-Brexit rules for Northern Eire.

Eire is booming but its creaking infrastructure, and housing particularly, is hampering companies’ skill to recruit and retain workers. Our Big Read explains.

€14.40 for a Maß of pilsener anybody? Regardless of the gloomy outlook for the German financial system, file numbers of drinkers are flocking to Munich’s Oktoberfest.

Must know: International financial system

The United Arab Emirates, which can host the UN’s COP28 local weather summit this yr, has offered to also host the follow-up meeting, giving it massive affect over world local weather coverage throughout a key two-year interval. COP29 was as a consequence of be held in japanese Europe however Russia has blocked any EU member nation turning into host within the wake of the Ukraine battle.

Zimbabwe’s president Emmerson Mnangagwa is getting ready to restart talks on $14bn of unpaid debt as deep divisions persist over disputed elections. His authorities is grappling with the collapse of the revived Zimbabwe greenback and triple-digit inflation.

UBS settled with the federal government of Mozambique over Credit score Suisse’s involvement in a £2bn alleged “tuna bond” fraud that wrecked the nation’s funds. The 2013 loans have been ostensibly to fund initiatives together with a state tuna fishery however later collapsed into default over the alleged looting of a whole bunch of tens of millions of {dollars}.

Japan’s prime minister Fumio Kishida requested buyers to “reassess our economy” as heads of world funds gathered in Tokyo for a sequence of occasions to draw funding. Learn extra in our particular report: Investing in Japan.

The Revival of the Japanese Inventory Market: Is that this time totally different? Register today for our unique subscriber webinar this Wednesday October 11 at 14:00 BST.

Must know: enterprise

Buying and selling in choices tied to the Vix volatility index — often known as Wall Road’s “concern gauge” — is ready to hit a file excessive as cautious buyers look to guard themselves from the risk of a sudden stock market reversal.

“There’s a darkish cloud hanging over inexperienced shares.” Shares in renewable vitality corporations have sold off sharply in recent months, considerably underperforming fossil gas corporations, as larger rates of interest take their toll.

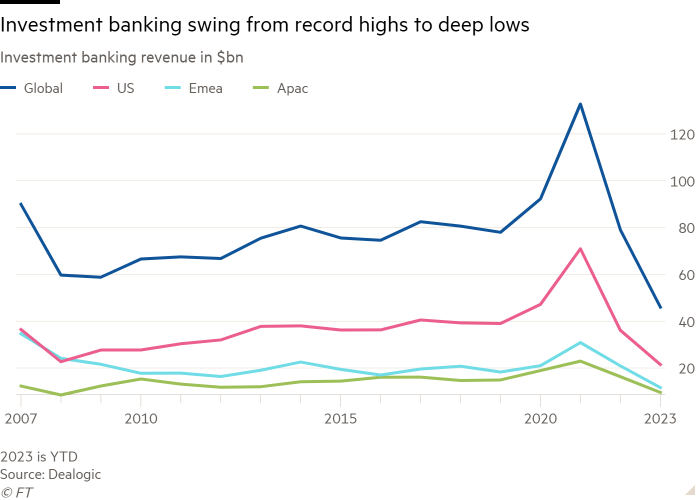

Wall Road bankers are hoping a rebound in dealmaking will raise bonuses and morale, however a return to the business’s 2021 peak seems a great distance off. Charges on company mergers, fairness raises and debt underwriting surged in 2020 throughout the pandemic and hit file highs in 2021, however exercise plummeted when central banks started aggressively lifting rates of interest.

The trial of FTX founder Sam Bankman-Fried, former poster youngster of crypto, will get below manner tomorrow. He’s accused of getting defrauded dozens of the world’s top investors in addition to tens of millions of consumers at his FTX cryptocurrency alternate and stealing billions of {dollars} entrusted to his custody.

America’s shale pioneers vowed to keep a lid on drilling even when oil hits $100 a barrel, hitting out at what they declare is a “battle” on fossil fuels waged by the Biden administration. Manufacturing cuts by Saudi Arabia and Russia have put up petrol costs, inflicting Biden a political headache as he seeks re-election.

UK water payments are set to soar by an average £156 a yr as suppliers search £96bn to fund funding within the water and sewage community. The plans, submitted in the present day to regulator Ofwat, come amid public anger over sewage outflows and the impact of worth will increase throughout a value of dwelling disaster.

Lovers of espresso and chocolate face higher prices and “shrinkflation” in product sizes as underlying commodity prices surge. Sugar costs hit their highest degree in 12 years this month whereas cocoa futures reached a four-decade excessive. It’s not wanting nice for cheese lovers both: latest floods have devastated Greek production of Feta.

The World of Work

Latest visits to picket strains by president Joe Biden and potential rival Donald Trump spotlight how employees’ rights are shifting to the centre stage of US political debate. The Hollywood writers’ strike is a working example.

What’s the distinction between a hook-up, a fling and a relationship? Administration editor Anjli Raval says this may occasionally now be required information for administrators at large corporations as private conduct turns into a growing risk for business.

Hybrid working has uncovered the inadequacies of modern office design, says columnist Pilita Clark.

Some excellent news

What’s believed to be the primary child beaver born in London for a whole bunch of years has been noticed in Enfield after the council and Capel Manor faculty started reintroducing the animals back to the capital.

Really useful newsletters

Thanks for studying Disrupted Occasions. If this article has been forwarded to you, please enroll here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thanks