This text is an on-site model of our Unhedged publication. Enroll here to get the publication despatched straight to your inbox each weekday

Good morning. The Nationwide Bureau of Financial Analysis formally declared yesterday that US long-term rates of interest have “gone bananas”. Really this isn’t true, nevertheless it needs to be. The ten-year Treasury yield has ripped by 4.6 per cent. That is getting slightly scary, however trying on the intense facet, the curve is much less inverted now? E mail us: robert.armstrong@ft.com and ethan.wu@ft.com.

Why small caps haven’t labored

Again in July, we wrote in regards to the case for small caps. It got here down to 2 elements: valuations and development. Multiples seemed affordable, particularly in contrast with the costly S&P 500. The Russell 2000’s value/e book ratio was properly under the historic common. And the smooth touchdown story was beginning to come collectively. As recession fears obtained priced out, the Russell would rally, we thought.

Effectively, er, about that:

The S&P has been falling since July, however the Russell has fallen additional. On valuations, the Russell has gone from low-cost to ultra-cheap. Its value/e book a number of is within the backside quintile of its vary stretching again to 1995. Generically, small caps are usually extra unstable in each instructions. However smooth touchdown remains to be many individuals’s base case and small caps stay far cheaper than the S&P. What derailed the case for small caps?

One factor is a downward revision to market development expectations. Mushy touchdown, we should always keep in mind, nonetheless implies a slowdown. Ryan Hammond of Goldman Sachs reckons that market pricing of GDP development has fallen previously a number of months from one thing like 3 per cent to 2 per cent, pointing to measures like defensives’ outperformance relative to cyclicals.

One other is the ambiguous spot we’re at within the financial cycle. As a rule, early cycle is once you need to personal the Russell. Small caps, with their heavy illustration of unprofitable minnow corporations, are inclined to dump exhausting because the cycle matures or falls into recession, usually adopted by a mighty rally as soon as development picks up once more. We confirmed you this chart again in July:

However currently, it’s not been fairly so clear if we’re in early cycle, late cycle or some ambiguous spot that defies the cycle framework. As such, it’s not clear small caps are due for an early-cycle rally anytime quickly.

Lastly, larger rates of interest are biting for small caps. As we wrote elsewhere in the Financial Times, S&P 600 curiosity expense per share has hit a report. Small-cap indices are laden with thin-margin corporations, and loads of unprofitable ones, so it’s not a stretch to determine the likelihood of defaults should be rising:

One level of hypothesis. The rise of personal fairness previously few many years could have sapped some vitality from the small-cap universe. As capital has flooded into PE funds, it is smart that they might have picked by the small-cap universe for corporations with potential, leaving a weakened group behind. That might match with a putting reality in regards to the Russell: the share of unprofitable corporations (on a 12-month ahead foundation) is one in three.

Nonetheless, any asset class, nonetheless junky, is smart on the proper value. With small caps traditionally very low-cost, maybe the purchase case has gotten stronger. Should you’ve a view, tell us. (Ethan Wu)

Charges and shares: making an attempt to kill a zombie with maths

On Tuesday, I argued, not for the primary time, in opposition to the zombie concept that rising rates of interest are particularly dangerous for development shares. To summarise: when inflation expectations and rates of interest rise, it’s not simply the low cost price on future income that modifications. Progress charges change too, for instance. So the “charges up = development underperforms” principle is at greatest a wild oversimplification and at worst simply false.

However analysts and pundits preserve at it. As if to taunt me, Bloomberg printed this in a market wrap this week:

The specter of tight coverage is undoing a number of the market’s greatest beneficial properties this yr within the high-flying tech shares. These development corporations are prized for his or her long-term prospects however maintain much less attraction when future income get discounted at larger charges.

However charges rose like loopy proper by the summer season, and tech shares did nice! What was occurring then? Argh!

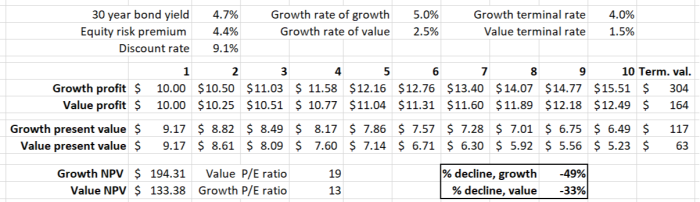

One more ultimate try, then, to place an finish to this mental virus. Let’s attempt it with numbers this time. Under is a quite simple web current worth evaluation of two imaginary corporations, one growth-y, one value-y. Sorry to these of you studying on cellular, who must squint:

Each corporations have the identical income as of yr one, however one will develop at 5 per cent for the following 10 years, the opposite at 2.5 per cent (I do know, development/tech corporations often develop quicker than 5 per cent, however I needed a flat price over 10 years so I shaded it down). I exploit the 30-year Treasury yield for the risk-free price, particularly the one from December 2021, when shares peaked. I borrowed the fairness threat premium calculated by Aswath Damodaran of NYU, once more from the tip of 2021. To calculate the terminal worth of every inventory on the finish of 10 years, I shaved a share level from each development charges. Sorry for all this boring arithmetic, I’ll make an fascinating level quickly, I promise.

As you’ll be able to see from the web current values at decrease left — the costs of the 2 shares, because it have been — a lowish low cost price and a highish revenue development price mix to make the expansion inventory look very costly, at 38 occasions this yr’s earnings. Most of that worth resides greater than 10 years sooner or later, within the terminal price. The worth inventory is inexpensive, at 20 occasions earnings, and its worth is weighted extra in the direction of the current.

Now let’s suppose there was a giant inflation shock and charges rose or, to place in one other approach, let’s use the 30-year Treasury price and the ERP from at this time, not late 2021, whereas holding every little thing else the identical:

The costs of each shares get crushed by the upper low cost price, however the development inventory, as a result of extra of its worth is out sooner or later, will get the worst of it. Its worth falls by half, versus a 3rd for the worth inventory.

Now let’s make one other assumption, to make the evaluation extra intently resemble the true world: the 2 corporations have inflation-offsetting pricing energy, however to totally different levels. Let’s suppose the expansion firm has larger pricing energy, and might enhance its nominal costs sufficient to maneuver its revenue development price to 7.5 per cent a yr, whereas the worth firm can push to 4 per cent a yr. Let’s push the terminal development charges up a bit, too. Now the image may be very totally different:

Now the worth inventory falls by greater than the expansion inventory. After all slightly twiddling with the inputs would get you a distinct end result, however that’s precisely the purpose. When you add in only one extra variable — pricing energy — the “charges up development underperforms” principle goes to items.

And it’s not arbitrary to assign extra pricing energy to the expansion shares. A part of what defines many development shares is that their companies have excessive obstacles to entry. Consider corporations most individuals are speaking about when they’re speaking about tech and rising charges: the magnificent seven. Apple and Microsoft are outlined by pricing energy; Meta and Google maybe much less so, however as promoting companies go, they should have extra leverage with purchasers than anybody else; in order for you an AI chip stack, it’s Nvidia or nobody proper now; Amazon and Tesla have niches the place they dominate, too. That is a part of why we’ve argued previously that Large Tech could show surprisingly defensive in a downturn.

None of that is to disclaim that the costs of growthy tech shares typically appear to have an inverse relationship with Treasury yields. The issue is we don’t appear to have a very good principle of why this occurs when it does. I believe the idea must pull from the arsenal of behavioural finance, with its emphasis on bias and overreaction, slightly than including extra macroeconomic variables. Extra on that tomorrow.

One good learn

Folks on X née Twitter are indignant about this New Yorker story in regards to the Bankman-Fried household, saying it lets Sam’s educational haute bourgeois dad and mom off the hook too simply, given their very own hyperlinks to FTX. However let me stick up for the author, Sheelah Kolhatkar: perhaps she trusted her readers to do the putting-on-the-hook themselves?

FT Unhedged podcast

Can’t get sufficient of Unhedged? Take heed to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the most recent markets information and monetary headlines, twice every week. Make amends for previous editions of the publication here.

Advisable newsletters for you

Swamp Notes — Knowledgeable perception on the intersection of cash and energy in US politics. Enroll here

The Lex Publication — Lex is the FT’s incisive every day column on funding. Join our publication on native and world developments from professional writers in 4 nice monetary centres. Enroll here