This text is an on-site model of our Unhedged e-newsletter. Enroll here to get the e-newsletter despatched straight to your inbox each weekday

Good morning. Immediately is the second of three weekly collaborations with Columbia College historian Adam Tooze. Ethan and I rely upon Adam’s Chartbook e-newsletter for the worldwide political and financial context we have to write Unhedged. Subscribe! Immediately the subject is the multipolarity thesis: the concept the world has shifted from unipolar US management, or a bipolar world organised round “Chimerica”, right into a world of a number of, shifting, partial, typically non permanent alliances. If multipolarity is certainly gaining momentum, the implications can be far-reaching. We’re eager to listen to readers’ ideas: robert.armstrong@ft.com and ethan.wu@ft.com.

Unhedged: in finance, it’s nonetheless a unipolar world

In a latest collection of articles, the Monetary Occasions described multipolarity when it comes to “the rise of the center powers” or, extra pithily, the “à la carte world”. A quote from commentator Nader Mousavizadeh offers one neat abstract of what which means:

The truth that the connection between Washington and Beijing has grow to be adversarial relatively than aggressive has opened up area for different actors to develop simpler bilateral relationships with every of the massive powers but in addition to develop deeper strategic relationships with one another.

Unhedged has its doubts. It’s true that the inclination of the US to venture energy across the globe appears to have diminished a bit underneath the previous three presidents. However does the multipolarity thesis actually add a lot to this primary remark?

Politics isn’t our space, nonetheless. What we are able to argue with some confidence is that within the realms of finance and markets, the world is as unipolar as ever and presumably extra so. Right here, the US stays indispensable, and we don’t see this altering any time quickly. This isn’t, we hasten so as to add, essentially a great factor for the US or the world. But it surely stays a truth, and a truth of main financial and political significance.

A part of the enchantment of the multipolarity thesis stems from the truth that the US share of worldwide output has shrunk. That is inarguable, however neither new nor accelerating; in actual fact, it’s an outdated pattern that has stalled in recent times, when multipolarity has (in principle) taken maintain. Up to now decade, the US and eurozone share of world GDP has fallen lower than a share level every:

In any case, an excessive amount of is fabricated from relative output shares. What’s extra essential to international markets is the centrality of the US monetary system and the greenback.

To know the greenback’s energy, think about the perfect options of a globally dominant forex. Karthik Sankaran, an FX markets veteran, says it have to be “unfailing”: a common and fungible asset, invoicing and legal responsibility forex. That’s, it have to be broadly accepted, fungible between monetary property and real-world items and providers, and helpful for invoicing transactions and underwriting loans throughout borders.

As soon as a forex boasts these options, community results make it sticky. So it’s with the greenback and, to a lesser extent, the euro. Take invoicing, how cross-border commerce will get settled. Even when a transaction is going on distant from the US, each side have an incentive to agree on a regular “automobile forex”, to minimise volatility and transaction prices. As soon as a worldwide invoicing customary is about, it’s annoying and costly to vary. This is the reason the greenback and the euro have seen rising invoicing use, even because the US and eurozone grow to be much less vital buying and selling companions. In cross-border lending, too, the greenback’s actual competitor isn’t the renminbi, however the euro:

Some dedollarisation proponents level to the renminbi’s rising share of worldwide central financial institution FX reserves. This chart ran within the FT in August:

This is a vital change, maybe accelerated by US sanctions coverage, and some analysts consider the greenback share dip is deeper than the chart above signifies. However the transfer isn’t but decisive, and it’s price remembering that central financial institution reserves exist much less as discretionary investments than as instruments to defend a rustic’s residence forex. The greenback makes up one leg of 88 per cent of all FX transactions, in contrast with 31 per cent for the euro and seven per cent for the renminbi. So long as that is still broadly true, the greenback share of reserves can solely fall to date.

Nearly as essential because the greenback are US Treasuries, the final word secure asset, indispensable as a haven, benchmark and collateral. The notion that American political or fiscal folly is about to unseat the Treasury is a long time outdated, however has grow to be standard once more prior to now yr or two as US deficits have ballooned and Treasury yields have risen. However Treasuries will retain their crown; the pretenders to the throne are lower than the job. Europe has no Treasury equal due to its lack of a real federal construction. China’s closed capital account and opaque markets make its debt unappealing to international traders. Japan’s capital markets are too shallow to rival the US.

If you wish to personal a nation’s liabilities, you must take into consideration the political stability and progress profile of that nation. What nation gives a greater mixture than the US?

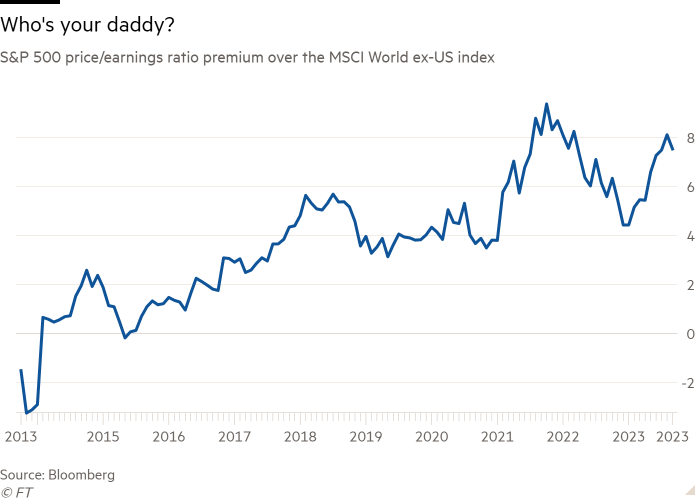

The ultimate bulwark of US monetary dominance is deep, open, steady capital markets which are residence to the best firms on the planet. The premium that traders are keen to pay to personal the fairness of US companies (and of worldwide companies listed on US exchanges) have solely grown in recent times:

Correspondingly, over the previous 10 years, US firms’ share of worldwide market capitalisation has grown from 37 per cent to 42 per cent, based on the Monetary Business Regulatory Authority. Sure, China’s IPO market has grown to rival or surpass the US’s in quantity, and huge regional firms like Saudi Aramco select native markets to listing. However when a very international firm involves market, there is just one possibility. Witness the latest US itemizing of Arm, previously a UK technological “champion”.

The openness and depth of US markets, and the authorized stability they supply, and the sheer dimension of the nation’s economic system — together with the truth that international locations resembling China and Germany have constructed export-driven, surplus economies — make the US the centre of gravity for international capital. Cash desires to return to America. The dimensions of international claims on US property is in contrast to wherever else on the planet:

As finance professor Michael Pettis convincingly argues, the flip facet of that is large US private and non-private debt, so America’s capital gravity is at greatest a blended blessing for its residents. However nonetheless it makes clear the indispensable position of the US within the international monetary system.

Adam, we’re eager to listen to should you assume the multipolarity thesis is true outdoors (or inside!) the monetary area, and the way the monetary and political economic system photos match collectively.

Chartbook: Multipolarity can run on the greenback

You make a wonderful case for the continued dominance of the greenback within the international monetary system. Such as you I’m a sceptic in terms of dedollarisation. The greenback’s centrality confers appreciable energy on the US. The influence of sanctions may be seen from Venezuela to Russia and Iran. In need of outright confrontation, the worldwide greenback cycle shapes the fortunes of your entire world economic system. China’s economic system developed from the Eighties onwards, like that of Japan and postwar western Europe earlier than it, inside a world economic system centred on the US.

However none of which means multipolarity is a delusion. Energy is at all times relative. Even within the Nineteen Nineties, the period we now consider as unipolar, it was China that determined to repair its trade fee towards the greenback at an especially aggressive fee, creating what some analysts dubbed Bretton Woods 2. That was a choice taken in Beijing not Washington, and China caught to its weapons regardless of appreciable strain from the US. 1 / 4 of a century later, China’s trade controls are as efficient as ever, marking a serious carve-out throughout the greenback system. And Russia has simply tightened its capital controls to allow it to proceed its battle economic system within the face of western sanctions.

Capital controls are actually no panacea. As you notice, they restrict the attractiveness of China’s monetary property and might result in painful macroeconomic imbalances. However in addition they give Beijing (and now Moscow) a level of management over the stability of funds. They restrict the greenback’s affect and that in flip radiates out to the massive array of nations that commerce intensively with China, whether or not that be Russia, Brazil or Saudi Arabia.

China was capable of uphold its place not solely due to its authoritarian regime, but in addition as a result of within the Nineteen Nineties and 2000s its technique of low cost exports and commerce surpluses sucked American pursuits in. US companies, customers and taxpayers realized to love a world of “twin deficits”. So deep was the symbiosis that Niall Ferguson and Moritz Schularick coined the phrase Chimerica.

The easiest way to consider at this time’s multipolarity is because the shattering of Chimerica. China’s ramified community of uncooked materials provides are not seen as environment friendly components of worldwide provide chains, however as a sinister geoeconomic community of affect. The boon of low cost imports morphs into the “China shock” that has compelled America and its allies right into a defensive crouch. In the meantime, Brazil and South Africa tout the Brics bloc as a substitute for western energy and African debtors’ try and stability China towards the west.

A lot of this multipolarity speak is clearly exaggerated. I agree that we ought to be sceptical about relatively synthetic measures resembling buying energy parity-adjusted GDP. However the big shift within the stability of the world economic system is simple. Take the local weather disaster. Emissions of CO₂ immediately mirror industrial exercise, vitality use and land clearance. Immediately, growing and rising market economies account for 63 per cent of CO₂ emissions. India’s complete emissions exceed these of the EU. China’s emissions are twice these of the US. That is multipolarity written within the starkest phrases. And it has big implications for the long run. If we really obtain an vitality transition it should by necessity be multipolar and its essential drivers can be China and the rising markets. Western traders and expertise could play a supporting position. However for all of the discuss “local weather finance” little or no cash has materialised. Proper now, Chinese language funding and low-cost expertise are dominating the vitality transition, which has triggered a defensive response from Europe and the US.

Multipolarity brings into the open what the Chimerica imaginative and prescient buried, specifically political and geopolitical variations. The South China Sea has grow to be a militarised zone. And the outdated battlefields of the chilly battle have sprung again to life, from Ukraine to Yemen by the use of the Caucasus, Syria, Israel and Palestine. On the face of it, that is one other dimension of energy wherein the US really has big superiority. However as you notice there’s little urge for food in Washington to truly use that energy and that’s hardly shocking after the disastrous experiences in Afghanistan and Iraq. Others are extra keen to take dangers. Regional gamers just like the Saudis and Emiratis know they will depend on US connivance and assist. Others like Russia’s Vladimir Putin, or Turkey’s Recep Tayyip Erdoğan, merely really feel sturdy sufficient to flaunt and even immediately problem the US.

Multipolarity reveals itself in trials of power. It consists in having the ability to uphold an impartial technique with appreciable influence at the least in your speedy neighbourhood. That doesn’t rely upon international metrics. It actually doesn’t rely upon attaining parity with the US, not to mention overtaking it. It relies on having relative freedom of motion in your speedy neighbourhood and having the ability to outlast your native antagonists and the larger powers which may be . The greenback system does certainly stay highly effective, however barring the imposition of a brand new geopolitical order, that isn’t by itself adequate to include the forces of uneven and mixed improvement.

FT Unhedged podcast

Can’t get sufficient of Unhedged? Hearken to our new podcast, hosted by Ethan Wu and Katie Martin, for a 15-minute dive into the newest markets information and monetary headlines, twice every week. Compensate for previous editions of the e-newsletter here.