Obtain free World commerce updates

We’ll ship you a myFT Day by day Digest e mail rounding up the most recent World commerce information each morning.

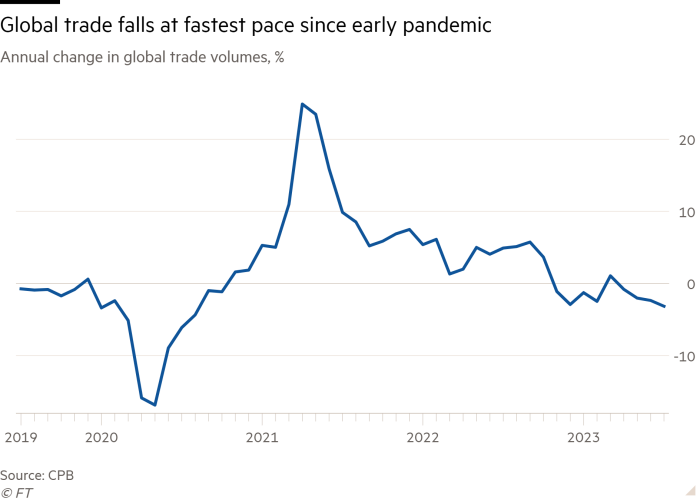

World commerce volumes fell at their quickest annual tempo for nearly three years in July, in line with intently watched figures that sign rising rates of interest are starting to affect world demand for items.

Trade volumes had been down 3.2 per cent in July in contrast with the identical month final yr, the steepest drop because the early months of the coronavirus pandemic in August 2020.

The most recent World Commerce Monitor determine, printed by the Netherlands Bureau for Financial Coverage Evaluation, or CPB, adopted a 2.4 per cent contraction in June and added to proof that world progress was slowing.

After booming throughout the pandemic, demand for world items exports has weakened on the again of upper inflation, bumper fee rises by the world’s central banks in 2022, and extra spending on home companies as economies reopened following lockdowns.

The about-turn in export volumes was broad primarily based, with many of the world reporting falling commerce volumes in July.

China, the world’s largest items exporter, posted a 1.5 per cent annual fall, the eurozone a 2.5 per cent contraction, and the US a 0.6 per cent lower.

Sentiment indicators advised that world commerce would stay weak within the coming months.

The S&P World buying managers’ index monitoring new export orders indicated a pointy contraction in August and September throughout the US, the eurozone and the UK. Economists now count on eurozone export volumes to be flat on the yr, after forecasting an growth of two per cent at first of the yr.

Whereas rates of interest aren’t anticipated to rise additional within the coming months, central banks are unlikely to chop borrowing prices till there’s extra proof that underlying worth pressures have been contained.

Analysts imagine the dearth of credit score easing will proceed to overwhelm on exports.

“With the lagged affect of excessive rates of interest prone to weigh extra closely on demand for sure items, it could possibly be a number of months earlier than world commerce reaches its trough,” mentioned Ariane Curtis, world economist on the consultancy Capital Economics.

Demand for imports of products which might be typically purchased utilizing borrowed funds — reminiscent of automobiles, residence furnishings and capital items — would weaken probably the most, Curtis mentioned.

Mohit Kumar, economist on the monetary companies agency Jefferies, mentioned commerce was prone to observe the pattern in world financial progress, the place he forecast a “slowdown in each single main financial system within the coming quarters”.

Together with weaker progress, geopolitical tensions had been additionally hitting commerce.

In its newest financial outlook, the Paris-based OECD highlighted how commerce restrictions have restricted export gross sales since 2018.

“Geoeconomic fragmentation and a shift to extra inward-looking commerce insurance policies would curtail the positive aspects from world commerce and hit residing requirements, particularly within the poorest nations and households,” the OECD warned.

The CPB additionally reported that world industrial manufacturing fell 0.1 per cent in contrast with the earlier month, pushed by sharp falls in output in Japan, the eurozone and the UK.

US industrial output was up 0.7 per cent, elevating hopes of a mushy touchdown for the world’s largest financial system, with inflation falling again to tolerable ranges with out triggering a recession.