Obtain free World updates

We’ll ship you a myFT Every day Digest electronic mail rounding up the most recent World information each morning.

This text is an on-site model of our FirstFT publication. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

Good morning.

The world’s monetary stability watchdog is launching a probe of the build-up of debt exterior conventional banks, because it seeks to restrict hedge funds’ borrowing and enhance transparency.

Klaas Knot, chair of the Monetary Stability Board, instructed the Monetary Occasions the assessment was meant to deal with rising dangers from so-called “non-banks”, which embrace hedge funds and personal capital.

“If we wish to arrive at a world the place these vulnerabilities are much less, we’ve to deal with this concern,” he stated, referring to the important thing position performed by non-banks’ debt in stoking current crises, such because the bond market meltdown at first of the pandemic.

Knot stated the assessment was a precedence as a result of non-banks’ leverage “can probably threaten monetary stability”. Read the full interview.

And right here’s what else I’m maintaining tabs on immediately and over the weekend:

-

Inflation: The EU’s headline fee is anticipated to have fallen to an virtually two-year low when the flash September determine is launched immediately. France additionally stories its flash shopper worth index.

-

Financial information: Germany’s unemployment fee for this month is forecast to stay unchanged when revealed immediately, whereas the UK releases gross home product figures for the second quarter.

-

Metropolis of London: An election might be held immediately for the 695th lord mayor of London, the top of the governing physique for the Sq. Mile.

-

Slovak elections: The events of former journalist Michal Šimečka and ex-premier Robert Fico are polling neck and neck forward of tomorrow’s vote.

-

UK Conservatives: The Tory celebration convention begins on Sunday in Manchester, with Prime Minister Rishi Sunak anticipated to deflect criticism over the HS2 high-speed rail venture and as an alternative focus on his “plan for motorists”. For extra UK politics, sign up for our Inside Politics newsletter.

How effectively did you retain up with the information this week? Take our quiz.

5 extra prime tales

1. Unique: The UK’s drive to strip Huawei from 5G networks has led to outages for Sky clients, even after the federal government prolonged a deadline to take away the Chinese language group’s gear over nationwide safety fears by a 12 months. Here’s more on the first sign of disruption, long warned about by industry executives.

2. Deloitte’s British and Swiss operations have warned of constant “difficult” circumstances within the UK this 12 months, regardless of being the one Massive 4 agency the place companions took house a median of greater than £1mn in its most up-to-date UK outcomes, and for the third 12 months working. Here are more details on the firm’s performance.

-

Extra Massive 4: EY is canvassing senior companions on a shortlist of six candidates for world chief government, following the resignation of Carmine Di Sibio within the wake of the collapse of his plan to interrupt up the accounting agency.

3. Unique: Singapore’s GIC offered its stake in a Vista Fairness Companions fund after the buyout agency’s founder was embroiled in a tax scandal, based on individuals aware of the matter. The sovereign wealth fund, one of many world’s most influential buyers, made a loss on its funding after disposing of its roughly $300mn holding at a reduction. Read the full story.

4. Linda Yaccarino is planning to satisfy the seven banks that helped bankroll Elon Musk’s takeover of X, previously referred to as Twitter, subsequent Thursday, stated individuals briefed on the matter. The corporate’s chief government will lay out her plans to revive the struggling social media firm. Here’s more on the high-stakes meeting.

5. European authorities bond costs dropped sharply yesterday as buyers took fright at Italy’s bigger than anticipated funds deficit and mounting considerations that central banks will maintain rates of interest excessive for an prolonged interval. Italian 10-year authorities bond yields rose to their highest stage in a decade, with the sell-off spreading to UK markets.

Information in-depth

The journey trade has reaped the rewards of a frantic summer time season, with airways reporting file income and accommodations on either side of the Atlantic having returned to close pre-pandemic occupancy. However it’s now going through an unsure winter and questions over whether or not the insatiable demand for holidays can stand up to persistently excessive inflation and financial stagnation, or is a post-pandemic bubble waiting to burst.

We’re additionally studying . . .

-

Soviet nostalgia: South Africans’ help for Russia is rooted in misplaced nostalgia, however condemning Moscow needn’t imply unthinking adherence to the west, writes David Pilling.

-

Lebanon’s rich: High-end hospitality is enjoying a resurgence, buoyed by those that had been insulated — and even profited — from the nation’s financial disaster.

-

Nuclear waste: Folks within the English coastal county of Lincolnshire are divided over plans to find an underground radioactive material disposal facility there.

Chart of the day

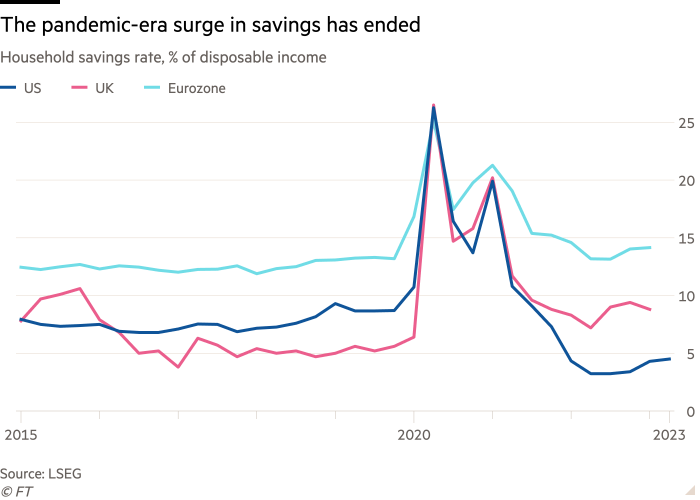

Broadly talking, US households have chosen to spend their piles of additional cash gathered throughout the pandemic. However Europeans largely held again, and it seems decreasingly likely that they will mimic American behaviour, writes Soumaya Keynes.

Take a break from the information

Autocracy is one thing immediately’s democracies thought they’d left behind, however two books — one targeted on antiquity, the opposite on trendy historical past — make clear how it’s enabled. Read the latest FT Books Essay by Martin Wolf.

Further contributions from Benjamin Wilhelm and Gordon Smith