This text is an on-site model of our Disrupted Occasions e-newsletter. Sign up here to get the e-newsletter despatched straight to your inbox thrice per week

At this time’s prime tales

-

Microsoft’s bid to accumulate video games developer Activision Blizzard moved closer to completion after the UK’s competitors regulator provisionally accepted the tech big’s amendments to its proposed $75bn takeover.

-

Washington and Beijing created two working teams to deal with economic and financial issues in a contemporary try to stabilise US-China relations. EU commerce commissioner Valdis Dombrovskis arrived in China with a long list of commercial grievances to debate.

-

The opposition Labour celebration stated it could strengthen the UK’s fiscal watchdog, the Workplace for Funds Duty, to keep away from any repeat of the federal government’s disastrous “mini” Funds, which occurred 12 months in the past tomorrow. Shadow chancellor Rachel Reeves outlined within the FT her plan to “bring back stability”.

For up-to-the-minute information updates, go to our live blog

Good night.

It’s been an eventful few days for the worldwide financial system with some vital central financial institution choices and a rising view that the top of rate of interest rises is in sight, whereas new surveys point out rocky instances forward for the UK and Europe.

Within the UK, the “flash” studying for the S&P World/Cips buying managers’ index this morning confirmed enterprise exercise slipping at the fastest rate since January 2021, suggesting the financial system was heading for recession. The rating of 46.8 for September was down from 48.6 final month, the place 50 marks the divide between exercise shrinking and increasing.

It follows the Financial institution of England’s determination on Wednesday to hold interest rates at 5.25 per cent, the primary pause after virtually two years of fee rises, following the discharge of better than expected inflation data.

The S&P knowledge, which the BoE had sight of earlier than its charges determination, highlighted the “mounting toll on the financial system from the fact of the elevated price of residing and the current speedy rise in rates of interest”, in line with the corporate’s chief enterprise economist Chris Williamson (though some economists warn that PMI outcomes can typically sign downturns that by no means materialise).

Throughout the Channel, the eurozone PMI studying was additionally in destructive territory at 47.1 however that was an enchancment on August’s 46.7 studying. A drop in new orders for business, nonetheless, added to fears of financial contraction within the third quarter, sending the euro to a six-month low in opposition to the greenback.

Buyers additionally guess the grim financial outlook made it extra seemingly that final week’s quarter-point interest rate rise by the European Central Financial institution could be its final. Nonetheless, yesterday’s hawkish remarks from Joachim Nagel, head of the Bundesbank, during which he stated “entrenched” inflation have to be prevented “at all costs”, recommend buyers shouldn’t turn into too optimistic. The OECD earlier this week additionally burdened the significance of keeping rates at elevated levels till inflation was actually tamed.

Within the US, at the moment’s PMI studying was barely constructive at 50.1, a seven-month low, as output stagnated with the services sector losing further momentum. The info follows the choice by the Federal Reserve on Wednesday to hold rates steady at their 22-year excessive however on the identical time signalling help for an additional fee rise this yr and fewer cuts in 2024.

Policymakers are nonetheless cautious of discussing the potential for fee cuts till there’s extra certainty that value stability has been restored, however the perception is rising {that a} change is coming. Or as one economist put it: “The worldwide financial tightening cycle has ended.”

Chris Giles, the FT’s economics editor, is launching a brand new e-newsletter on central banks for premium subscribers. To ensure you obtain the primary version on October 17, register here.

Have to know: UK and European financial system

The FT revealed that UK carmakers would nonetheless face stringent electric vehicle sales targets, regardless of Prime Minister Rishi Sunak’s determination to delay a ban on new petrol and diesel vehicles, a call condemned by the FT editorial board. Right here’s an explainer on what Sunak’s internet zero pivot means for UK local weather objectives and the subsequent election, and right here’s how net zero became an election issue around the globe.

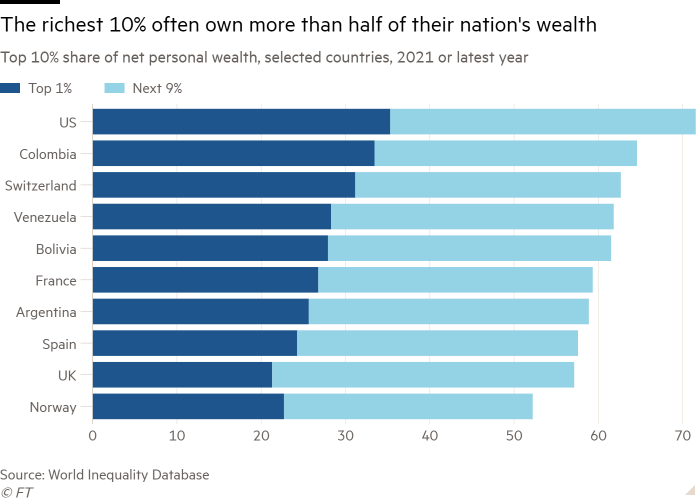

As battle strains sharpen between Sunak and Labour chief Sir Keir Starmer forward of the final election, a brand new survey exhibits public help within the UK for “large authorities” has hit a record high. Our Large Authorities collection in the meantime examines the case for a wealth tax, which some economists say is due a resurgence.

The Italian financial system grew 1.3 per cent more in 2021 than initially estimated, offering some aid to Prime Minister Giorgia Meloni’s authorities because it prepares subsequent yr’s price range.

Have to know: world financial system

A Large Learn examines how Chinese language president Xi Jinping is taking control of the country’s stock market as he tries to spice up funding in sectors that match together with his priorities for management, nationwide safety and tech self-sufficiency. International buyers, nonetheless, are still dumping Chinese language equities.

Within the first of a three-part collection, the Rachman Review podcast discusses Bidenomics and whether or not it’s working effectively sufficient to persuade US voters to re-elect Joe Biden as president subsequent yr.

Analysis exhibits organised felony teams in Mexico make use of as much as 185,000 folks and attract hundreds of recruits every week, highlighting the issue of dismantling the cartels and decreasing violence within the nation.

Chief knowledge reporter John Burn-Murdoch charts how slowing financial development many be shaping attitudes that cut across political divides. A key development is the predilection for zero-sum considering, the assumption that for one group to realize, one other should lose.

Have to know: enterprise

Rupert Murdoch stepped down as chair of Fox and News Corp, handing management to his eldest son Lachlan. It’s unclear, nonetheless. what may occur when the 92-year-old dies and his youngsters gain control over the Murdoch family trust.

MSC, Europe’s largest cruise firm, is pitting itself in opposition to environmental campaigners by calling for the UN delivery regulator to rethink new rules grading ships on carbon emissions, arguing that the foundations “penalise” passenger operations.

UK retail gross sales bounced again and shopper confidence elevated to the highest level since January 2022, highlighted by one other increased profit forecast from garments retailer Subsequent. Retailers are more and more involved, nonetheless, a few surge in shoplifting and abuse of staff.

India is the world’s fastest-growing main financial system however progress is uneven, with the hole rising between wealthy and poor. Enterprise progress can be uneven: just 20 companies take 80 per cent of the profits generated by the Indian financial system.

Might local weather change kill the pint? The top of Japanese brewer Asahi warned of beer shortages as warmer temperatures hit supplies of barley and hops.

Science round-up

The World Well being Group urged China to supply extra details about the origins of Covid-19, and stated it was able to ship a second crew to look into the matter, virtually 4 years after the primary circumstances emerged within the metropolis of Wuhan.

Right here’s our explainer on how the current catastrophic flooding in Libya was fuelled by a “medicane” — an intense Mediterranean cyclone with hurricane-like traits. And right here’s our decide of latest books on climate and the environment.

A brand new synthetic intelligence instrument from Google DeepMind might help predict whether mutations in human genes are likely to be harmful.

Analysis means that suppressing destructive ideas is good for your mental health, contradicting the frequent perception in psychology that it’s higher to speak about distressing concepts and recollections.

Are we getting nearer to having the ability to “converse whale” or chat with bats? A captivating new collection of our Tech Tonic podcast investigates whether or not synthetic intelligence could help us speak to animals.

Some excellent news

Researchers in Scotland consider they might have produced an alternative choice to palm oil, the ingredient found in almost half of all food and cosmetic products however which causes important deforestation the place it’s harvested.

Thanks for studying Disrupted Occasions. If this text has been forwarded to you, please enroll here to obtain future points. And please share your suggestions with us at disruptedtimes@ft.com. Thanks